The property market in 2022: Three key trends you need to know about this year

House buyers are borrowing more than ever, and paying more for the privilege thanks to increasing interest rates — and they're also looking for different things than once they were.

Borrowing is still booming — but for how long?

The story a month ago was that more people are borrowing more money, according to Bank of England figures. The number of approvals dropped in February, but in all honesty the drop was small enough (70,933 in February compared to January's 73,841) that it's quite possibly a statistical glitch due to the short month. And while the number of mortgages might be down, their value is up; in February the total value lent rose from £16.6bn to £16.7bn despite the drop in numbers, and the average value of a mortgage loan is 10.4% higher than this time last year. On top of that, average 2-year fix interest rates are also substantially higher: 1.65% compared to 1.3% a year ago, base on a 60% LTV mortgage.

None of this is to say that the market is still soaring upwards: mortgage lending always trails the property market, since no money is actually lent until completion. And Savills' director of research Lawrence Bowles pulls no punches in his warning that things will change before long: 'With the Bank of England looking set to increase the base rate of increase further through the year, we can expect to see further rises in mortgage interest costs. That will limit what buyers can pay, especially with the affordability stress tests currently in place and rapidly rising energy prices putting pressure on household finances.

‘While the imbalance between resilient demand and very low level of stock available is continuing to support price growth, we can expect to see mortgage advances and other measures of transaction activity start to ease as we head towards the autumn.’

Tom Bill of Knight Frank appears to be more cautious in his analysis, citing the relatively small amount of new property on the market: despite the expected ‘spring surge’, the effect of Covid on the property market is going to ‘linger for longer’, he says. Demand is ‘consistently strong’, but as to supply, ‘there was only a modest increase in the first six weeks of this year’.

Cathedral cities are more popular than ever

‘We are now seeing demand 20% higher for properties in these cathedral cities than the country at large,’ says Dominic Agace, chief executive at Winkworth. The cities most benefiting from the effect are Bath, Winchester, Canterbury and Exeter, with buyers keen from within the UK and overseas — in particular South-East Asia.

Why now? Agents put it down to the ongoing demand for hybrid working in a post-pandemic world. They also cite the Bridgerton effect, though we're not sure why someone would be inspired to buy a house because of the second series of a Netflix show... still, it all helps the PR department write their emails.

Many people are returning to cities, but their priorities have changed

‘The rush to the country was magnetic at the start of the pandemic,’ says Will Watson, partner at The Buying Solution, 'but we’re now seeing many more migrating back — there’s been a 50% increase on the same time last year. Homes in the capital need to work harder than ever as buyers want to find that classic balance between rural and urban.’

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Developers are already responding, and are having to incorporate a dose of rural living into their schemes. Enter the ‘mud room’, which the team behind 80, Holland Park — Christian Candy’s W11 development — believe is the next big thing. The room has a huge dog shower and hairdryer for the use of the residents of its 25 apartments.

Reporting: Annunciata Elwes, Carla Passino, Toby Keel

Credit: Strutt and Parker

Best country houses for sale this week

An irresistible West Country cottage and a magnificent Cumbrian country house make our pick of the finest country houses for

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

From California to Cornwall: How surfing became a cornerstone of Cornish culture

From California to Cornwall: How surfing became a cornerstone of Cornish cultureA new exhibition at Cornwall's National Maritime Museum celebrates a century of surf culture and reveals how the country became a global leader in surf innovation and conservation.

By Emma Lavelle Published

-

18 magnificent homes for sale from £550k to £20 million, as seen in Country Life

18 magnificent homes for sale from £550k to £20 million, as seen in Country LifeFrom a charming thatched cottage to a 300-acre estate with its own vineyard, here's our pick of places to come to the market via Country Life of late.

By Toby Keel Published

-

18 magnificent homes for sale from £550k to £20 million, as seen in Country Life

18 magnificent homes for sale from £550k to £20 million, as seen in Country LifeFrom a charming thatched cottage to a 300-acre estate with its own vineyard, here's our pick of places to come to the market via Country Life of late.

By Toby Keel Published

-

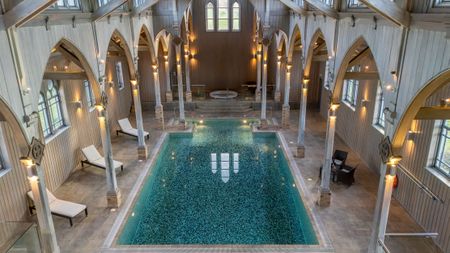

If heaven is on earth, it might be in this home with a converted chapel that is now a swimming pool

If heaven is on earth, it might be in this home with a converted chapel that is now a swimming pool5 Wood Barton Town House is part of an exclusive 80-acre development in Devon that also comes with fishing rights on the River Avon and four bedrooms.

By James Fisher Published

-

The sounds of spring and stained glass in an Arts-and-Crafts masterpiece in Dorset

The sounds of spring and stained glass in an Arts-and-Crafts masterpiece in DorsetWith 35 acres, more than 10 bedrooms, a swimming pool and tennis court, Winterfield has it all.

By James Fisher Published

-

An eight-bedroom wonder in East Sussex where the outdoors are an adventure

An eight-bedroom wonder in East Sussex where the outdoors are an adventureThe interiors of Old Middleton are pretty good too.

By Arabella Youens Published

-

A lakeside farmhouse on the market in the beautiful heart of Pembrokeshire

A lakeside farmhouse on the market in the beautiful heart of PembrokeshireA lake, streams, 15 acres and five bedrooms. Rogershook might have it all.

By James Fisher Published

-

An idyllic countryside home that's light, spacious and comes with a Grade II-listed folly

An idyllic countryside home that's light, spacious and comes with a Grade II-listed follyHagg House is a gorgeous family home that just happens to have a miniature castle in the gardens. Annabel Dixon explains more.

By Annabel Dixon Published

-

A historic villa for sale on the Via Nomentana worthy of Rome's rich history

A historic villa for sale on the Via Nomentana worthy of Rome's rich historyThree floors, lots of balconies, and a private garden in one of Rome's loveliest neighbourhoods.

By James Fisher Published

-

Eight bedrooms of unlisted Edwardian elegance with sweeping views of Somerset

Eight bedrooms of unlisted Edwardian elegance with sweeping views of SomersetAshton House sits near the market town of Chard and comes with a wealth of amenities both inside and out.

By Arabella Youens Published