Market Looks Bright For 2007

Prime property prices will continue to increase in 2007, with the London boom spreading across the whole South West, predicts Knight Frank

More house price growth is expected next year ? particularly at the top-end of the market, according to research from Knight Frank. Although the growth will be slower - at 6% - than the predicted 2006 end of year rate of 9%, Knight Frank is forecasting a strong market in 2007. ?The housing market, which staged an unexpectedly strong recovery in 2006, is expected to remain in robust health throughout 2007,? commented Liam Bailey, head of Knight Frank residential research. Above average growth in Scotland and Northern Ireland is expected next year, before slowing in 2008: ?Scotland and Northern Ireland will lead with growth at above 10%, reflecting the tail end of the 2000s boom still fizzling in the far north and west of the UK,? said Mr Bailey, ?Pockets of ?excess? (in comparison to the rest of the UK) affordability will be squeezed out during 2007,and both Scotland and Northern Ireland will under perform the UK average from 2008. The London boom will continue to spread, according to Knight Frank, extending from Cornwall to East Anglia, prompting more 25% price rises in certain micro-locations as buyers from London compete with locals. ?Price growth will be especially pronounced in the prime UK markets, especially at the top-end of the market,? Mr Bailey predicts. Prices for London?s best properties have risen by 404% since 1986 when the ?Big Bang? enabled London Banks to buy brokers and merge their services on vast Wall Street style trading floors. The increase outstrips the FTSE 100 index over the same period. ?The reforms in the City not only cemented its position, but also led to the rise of serious wealth from an already wealthy source,? explained Mr Bailey. ?Over the 20 year period since 27 October 1986, the number of City employees has risen by 34% - with an additional 82,000 people now working in City related jobs?. The rise in City employment is good news for the future of the prime property market. ?Prices in central London now stand 23.5% higher than they did only 12 months ago,? said Mr Bailey. ?September was an extraordinary month for the prime London market. Buyers came back in serious numbers after the summer break. Our records reveal that the number of buyers registered to purchase property in central London is 111% higher than the same period last year.?

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

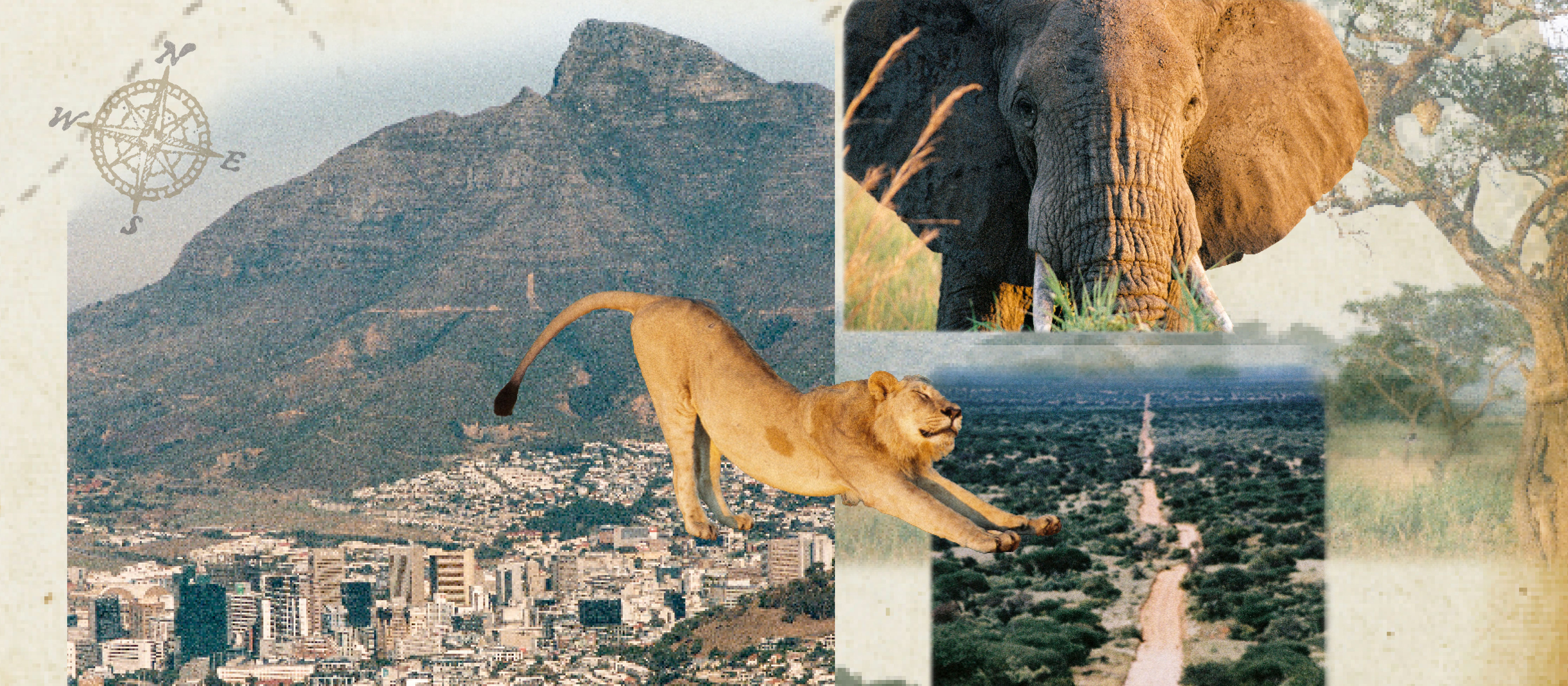

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to CairoWhy do we travel and who inspires us to do so? Chris Wallace went in search of answers on his own epic journey the length of Africa.

By Christopher Wallace Published

-

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River Tay

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River TayCarnliath on the edge of Strathtay is a delightful family home set in sensational scenery.

By James Fisher Published