House Price Crash Unlikely in 2007

Higher house prices and outperforming property markets are expected in 2007 – not a property crash or soft landing, according to Savills' research

The housing market is not about to crash, according to the latest Savills UK Residential Research Bulletin. Low growth in 2005 seems to have constituted the full extent of the housing market slowdown, with house price inflation excelling in 2006. 'Strong demand coupled with competition for very short supply of the right type of property in the right place will fuel further price rises,' Yolande Barnes from Savills Research commented, 'We are forecasting growth in the UK residential market of 7% in 2007.' Only a severe external economic shock or very unpleasant inflationary surprise could cause prices to plummet, according to Savills. An annual price growth of 9% is predicted for the end of 2006 with growth in prime central London as much as 20%. Prime and southern markets are leading growth, fuelled by overseas equity and City bonuses,' said Ms Barnes. 'Prime markets look set to out perform the mainstream and we can expect to see high growth in the prime country house market as they're a rare commodity that is not being made anymore.' Growth of 15% is forecast for prime central London in 2007, leading Savills to conclude the market slow down in 2005 has been reversed. 'At the moment, it looks as if the housing market 'landing' was a positively bouncy one - and that the '2005 slowdown' was the full extent of it,' Ms Barnes explained. Thus Savills contradicts David Miles at Morgan Stanley who is predicting a substantial fall in house prices in the near future due to the speculative nature of the market. 'We believe the housing market is not overheated and there is no bubble to burst. Price levels are high and large, growing numbers of households are unable to buy their homes but this is due to inadequate supply rather than a speculative bubble,' said Ms Barnes.

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

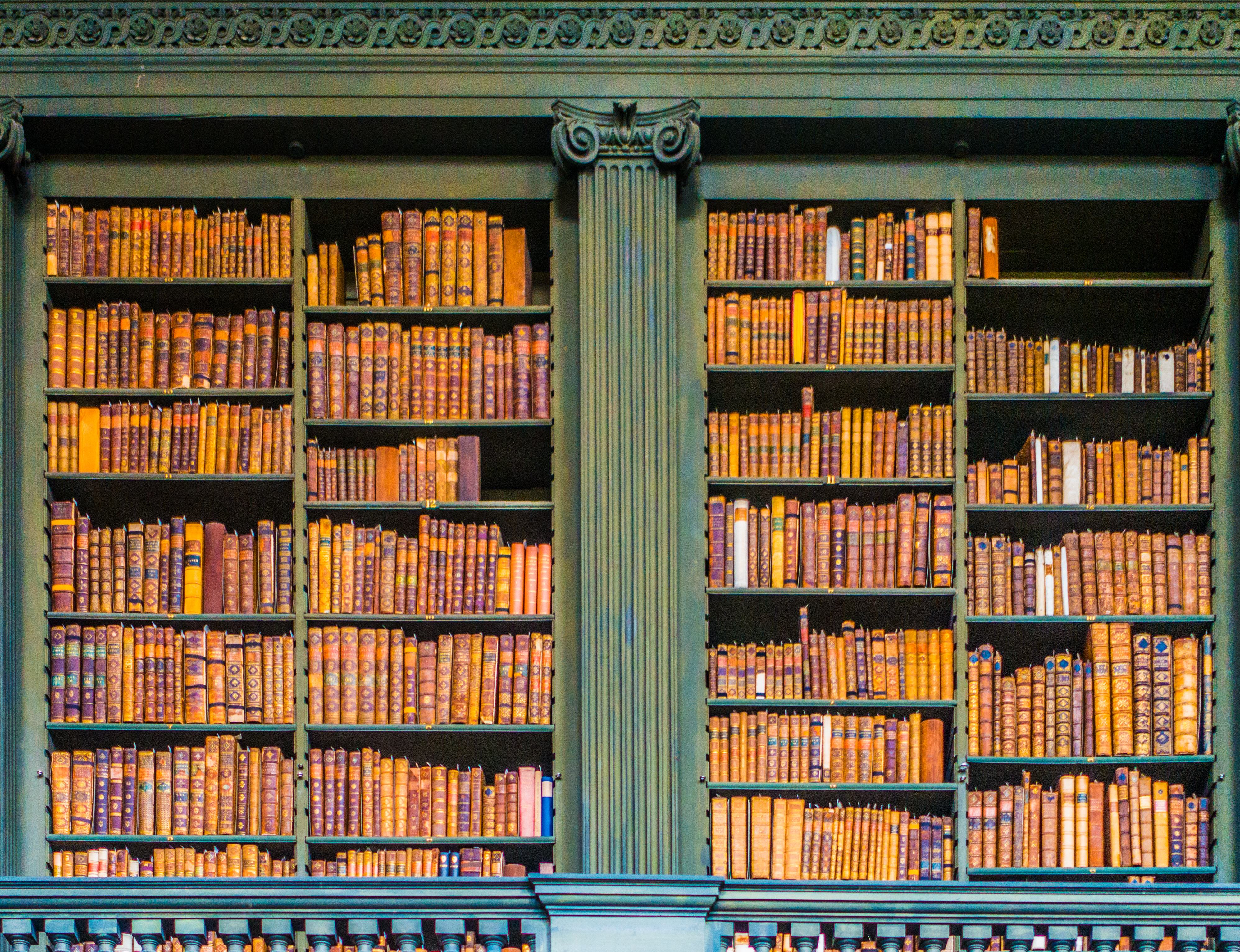

'To exist in this world relies on the hands of others': Roger Powell and modern British bookbinding

'To exist in this world relies on the hands of others': Roger Powell and modern British bookbindingAn exhibition on the legendary bookbinder Roger Powell reveals not only his great skill, but serves to reconnect us with the joy, power and importance of real craftsmanship.

By Hussein Kesvani Published

-

Spam: The tinned meaty treat that brought a taste of the ‘hot-dog life of Hollywood’ to war-weary Britain

Spam: The tinned meaty treat that brought a taste of the ‘hot-dog life of Hollywood’ to war-weary BritainCourtesy of our ‘special relationship’ with the US, Spam was a culinary phenomenon, says Mary Greene. So much so that in 1944, London’s Simpson’s, renowned for its roast beef, was offering creamed Spam casserole instead.

By Country Life Last updated