Invest for your children

Buying property as an investment for your children could be a wise move, says Phil Spencer

Soaring property prices are causing many parents and, in some cases, grandparents to worry whether their children will ever be able to buy their own home. Some are delving into the student property market, but others are tackling the problem even sooner, and buying property for their children when they are barely out of the cradle. 'Handout homes' properties bought by one person for the use of another are fuelling the UK second-home market. There are currently 327,000 handout homes in the UK. A quarter of these were purchased by parents to house their children as students at university a 26% increase since 2000. Very often, the overriding factor is peace of mind for the parent, knowing their child has somewhere suitable to live. This 'university effect' has become a tangible driver of the UK second-property market, and looks set to continue. Many university towns and cities have outperformed national average house price rises in the past five years. According to figures published by Halifax, Edinburgh prices rose by 97%, Durham by 122%, Bath by 78% and St Andrews by 87%. The number of first-time buyers under the age of 30 receiving 'substantial' financial help from relatives has risen to 46% from 10% since 1995, according to the Council of Mortgage Lenders. It is difficult to find statistics about the 'circle of money' removed from equity lying dormant in family houses which reappears as a deposit on a first-time purchase, but, given that there has been no decline in first-time buyer activity since 2001, despite worsening affordability, rest assured that it is a massively increasing tendency. It is more tax-efficient to purchase the property in the child's name with the parents' financial assistance. Assuming the property is the student's principal private residence, there is no capital gains tax to worry about. As students are unlikely to have an income, parents will have to act as a guarantor on a mortgage. The lender assesses affordability on the parents' incomes, but will also want to see there is a good chance of the child taking over the mortgage in the future. Key pointers to remember are that the property you are buying is for your child. Always look at comparable values in the area before purchasing a property to check that you are paying a fair price. A parent must consider that lifestyle, tastes and situations can change quickly in early adulthood. But there are plus sides: we at Garrington bought a flat for parents of children going to UCL. Although they chose not to spell it out at the time, the parents liked the fact that they both had some 'control' over where their daughters lived, and that it would ensure they lived together. The investment was just a plus. The dilemma broadens when there is more than one child in the family. Depending on the time differential, which could be a number of years, and the prevailing market conditions, this could mean that you are able to buy considerably less property at a later stage. Do you buy by type or by budget? My wife and I have already bought both our sons (aged one and three) three-bedroom houses on the same street in south-west London. Deposits were invested and rents cover the mortgages. Even if we're able to do nothing else for them, they'll own the roofs over their heads (I don't imagine for a minute that either of them will have inherited the required intellect to command a graduate salary to support a £1 million mortgage, which is probably what a £300,000 property today will be worth when they leave home in 20 years' time!). They could choose to live in the properties themselves (in which case, they're almost next door to each other), or use the rents to help themselves buy somewhere else. But with a tangible asset like a house, as opposed to a pile of cash, it will be much harder for them to burn through it on fast cars and holidays. Buying property for children does need careful planning. Although it can be complicated, it can also be an extremely shrewd investment. If you aren't familiar with the area where you're purchasing or don't have sufficient time to dedicate to the task, it's almost certainly worth retaining the specialist advice of a purchasing agent. As with any investment decision, it's never wise to proceed without unbiased and up-to-date information. Contact Phil Spencer Garrington 219 Harbour Yard, Chelsea Harbour, London SW10 0XD Tel: +44 (0) 20 7376 6780 Fax: +44 (0) 20 7376 6781 E-mail: info@garrington.co.uk Garrington

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

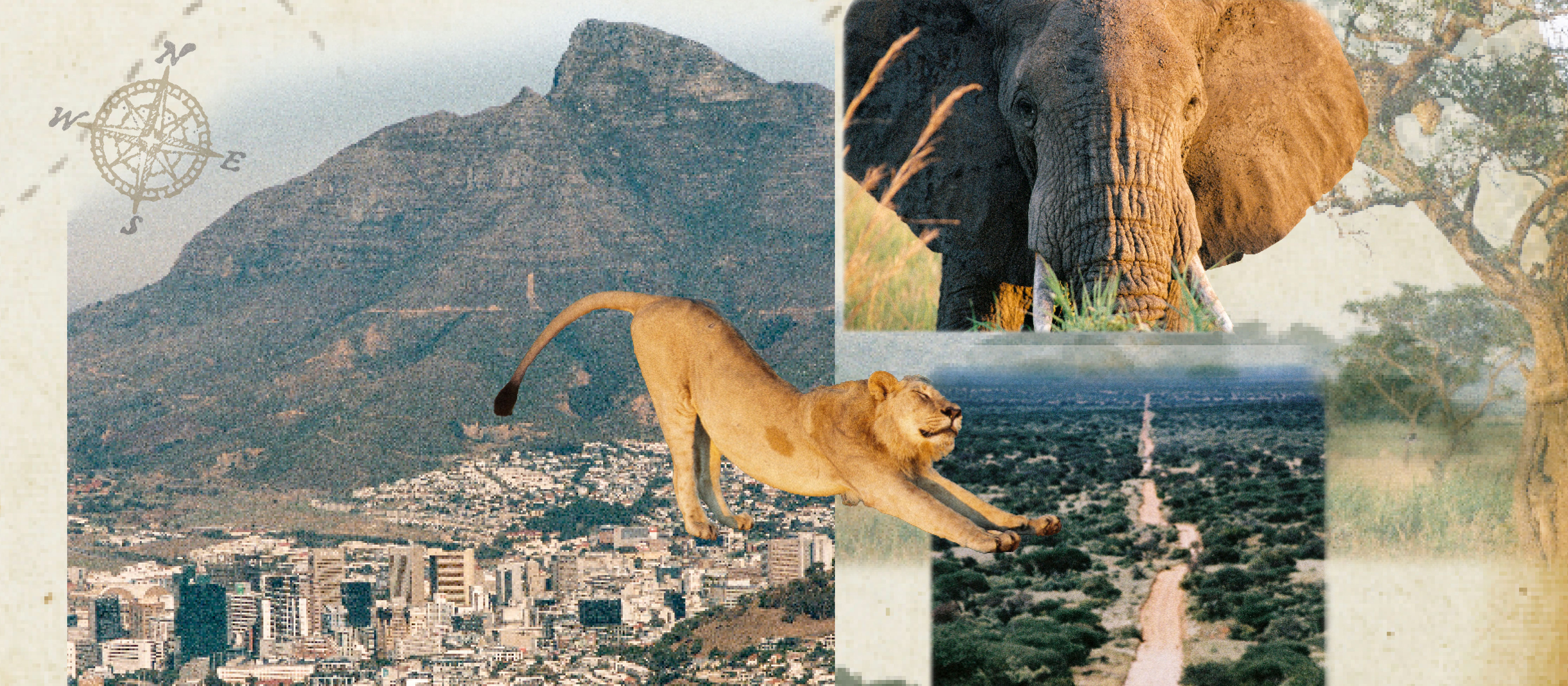

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to CairoWhy do we travel and who inspires us to do so? Chris Wallace went in search of answers on his own epic journey the length of Africa.

By Christopher Wallace Published

-

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River Tay

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River TayCarnliath on the edge of Strathtay is a delightful family home set in sensational scenery.

By James Fisher Published

-

What to expect when you're expecting (to move to the countryside)

What to expect when you're expecting (to move to the countryside)On March 28, agents Michael Graham will be showcasing some of their best countryside properties at their west London office.

By James Fisher Published

-

Property Talk: When is the right time to downsize?

Property Talk: When is the right time to downsize?Sometimes our homes can get too big for us, meaning it’s time to downsize. Here, we speak to those involved with the process.

By James Fisher Published

-

How to win in the property market: Tips from some of Britain's best buying agents

How to win in the property market: Tips from some of Britain's best buying agentsWhether looking for the perfect family home or negotiating on price, buying agents do the heavy lifting–and are well used to analysing the market. Carla Passino gets advice from a few of the best.

By Carla Passino Published

-

Top tips on renting your holiday home

Top tips on renting your holiday homeThe holiday-home market on the Cornish coast looks set for a lively summer. Arabella Youens finds out how to make the running costs bearable.

By Arabella Youens Published

-

Tips and advice for holiday home owners

Tips and advice for holiday home ownersWith the start of the summer season nearly upon us, more and more country-house owners are dipping into the short-let scene.

By Country Life Published

-

Property guide to Elstead

Property guide to ElsteadFreddie Mack shares the secrets of Elstead in Surrey, a prime spot for young families looking for properties outside London near good schools

By Country Life Published

-

Property guide to Cheriton

Property guide to CheritonIf you're considering buying property in or around Cheriton this year, take a look at our property guide which covers where to buy, what prices to expect and where to have fun in the area

By Country Life Published

-

Make your holiday let work for you

Make your holiday let work for youIf you're considering renting out your holiday property prepare by reading this first

By Country Life Published