Downsizing – planning your retirement

What to look at when deciding to downsize into a smaller property for retirement years

How we plan for retirement, and how we fund it, are becoming two major issues of our times. Most pension advisers suggest that you plan for 25 years of retirement, which can put a strain on the finances of even the most prudent savers. However, ‘the situation isn't all gloom, because the older generation has lived through successive housing booms, and about 70% of over-65s are homeowners in a position to downsize and release equity,' says Emma Cleugh of Knight Frank, a specialist in retirement housing. The Council of Mortgage Lenders concurs, estimating that there's about £1 trillion of housing equity in the hands of people over 60.

Moving to a smaller house is the obvious choice for most retirees. ‘They want to release equity to fund the later years, to pass on to the younger generation, or to pay the grandchildren's school fees,' says William Marsden-Smedley of Prime Purchase. This will not only allow you to free up capital from the sale, but also to reduce the ongoing maintenance costs that are linked to running a large house, such as heating.

Releasing equity isn't the only reason to consider downsizing. A home that's perfect for a family with children may turn into a burden when you get older, especially if it has features that can become difficult to maintain or negotiate, such as numerous flights of stairs or a large plot of land. Mr Marsden-Smedley recently helped a couple to downsize. ‘They wanted to shed the financial and maintenance worries of running a big house, so we found an easy-to-manage village house where they could have a cleaner three times a week and someone to mow the lawn in the summer.'

Where to buy is as important as what to buy. Being close to family is a great benefit for retirees, but easy access to shops, doctors and cultural amenities all matter, as does a location with good access to public transport. Research by Knight Frank shows that, although older buyers have tended to gravitate towards beauty spots and coastal havens in the past, they are increasingly moving closer to towns and cities, which offer superior facilities within walking distance. ‘You need a village with a shop, a surgery and a pub. Or a market town with a bank, shops and a good supermarket,' advises Private Property Search's David Milligan.

Retirees can make changes to their existing house-for example, ensuring that they can easily move from room to room, that at least one bedroom is on the main living floor, and that surfaces are slip-resistant (see Country Life, November 3, 2010)-or they can buy into a retirement development built by specialists such as Churchill Retirement Living. These properties are generally close to shops in good market towns, and have grab rails, waist-level electrical sockets, lifts, shared common rooms, call and alarm systems and managers who keep an eye on residents.

Then there are homes that offer a more comprehensive service. Last year, editor and author Diana Athill decided, in her nineties, to move into a home for the active elderly in Highgate, London. She now feels ‘beautifully looked after'. Newlands Court, in Stow-on-the-Wold, offers a range of care options. You can rent or buy cottages (prices from £399,950) with a country-club atmosphere, with assisted living or full nursing care. A two-bedroom assisted living apartment at Newlands Court costs from £535 per week to rent, excluding service charge and assisted-living fee.

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

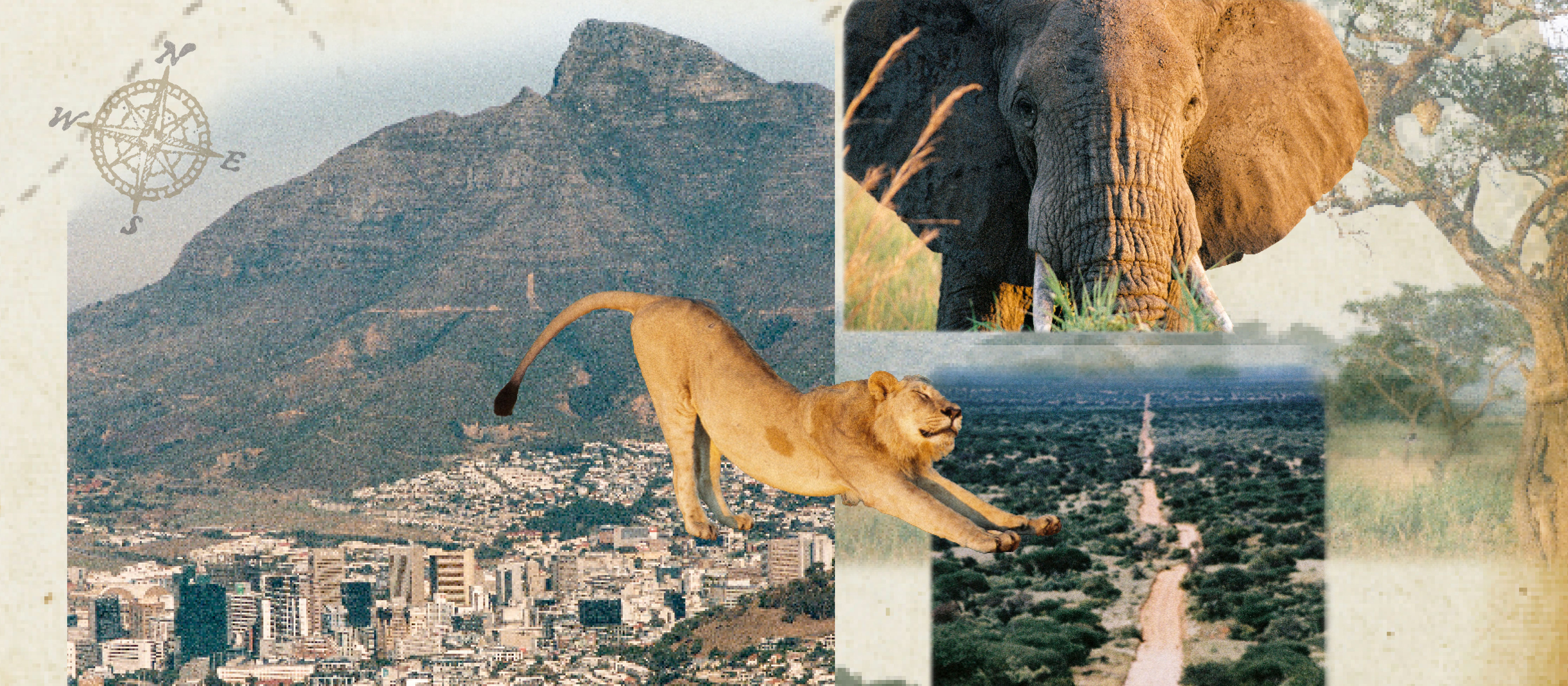

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to CairoWhy do we travel and who inspires us to do so? Chris Wallace went in search of answers on his own epic journey the length of Africa.

By Christopher Wallace Published

-

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River Tay

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River TayCarnliath on the edge of Strathtay is a delightful family home set in sensational scenery.

By James Fisher Published