Budget 2015: Key points for property owners in the UK

From 'non-doms' to downsizers, how does the Budget affect you as a property owner in the UK?

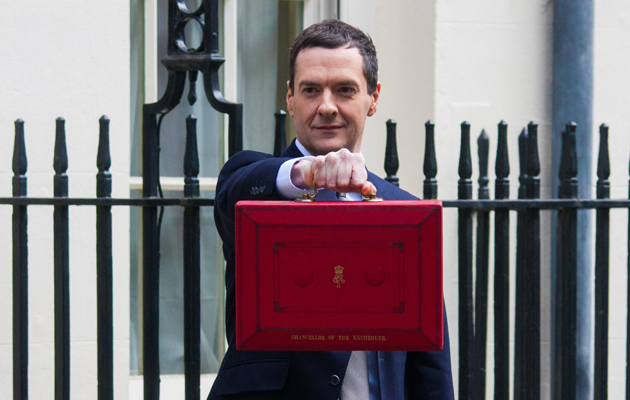

Inheritance Tax George Osborne lightened the burden of Inheritance Tax (IHT) in the first all-Conservative Budget since November 1996. Fulfilling a key electoral pledge, the Chancellor said that, starting from April 2017, he will phase in a new £175,000 family-home allowance on top of the current IHT threshold, which stands at £325,000. This will bring the total IHT-free allowance to £500,000 per person by 2020–21.

Spouses and civil partners will be able to transfer both allowances to each other. As a result, they will be able to leave estates worth up to £1 million to their children or grandchildren. IHT will continue to be levied at 40% on assets in excess of the threshold and the tax allowance will be tapered away for estates worth more than £2 million.

Downsizers The Chancellor also announced that, under the new rules, downsizers will keep the IHT allowance they would have been entitled to when living at their original property even after they move to a lower-value one. ‘The wish to pass something on to your children is about the most basic, human and natural aspiration there is,’ Mr Osborne explained when presenting the measure to the Commons.

The change, explains Gráinne Gilmore of Knight Frank, allows wealth to flow down from older to younger generations rather than to the Treasury. The provision for downsizers in particular ensures larger houses will continue to come onto the market, although Miss Gilmore cautions that, with the relief being introduced gradually over the course of the next four years, people may decide to stay put for longer than they would have otherwise done.

Lucian Cook of Savills believes the IHT changes will bring the greatest benefit to older homeowners in London and the South-East. Insurer NFU Mutual also identifies Dorset, Gloucestershire, Yorkshire, Cheshire and Somerset as some of the counties that will gain from the move because they have a very high concentration of properties worth £1 million.

However, NFU Mutual’s chartered financial planner, Sean McCann, points out that inflation and future house-price increases will quickly eat into the new IHT allowance, especially when considering that the basic £325,000 threshold, which has been in place since 2009, will be frozen until 2021. To avoid missing out on the maximum allowance possible, the company urges homeowners to have their properties revalued.

‘Non-doms’ The Budget focused as much on making taxation fairer as on reducing it. In particular, the Chancellor overhauled non-domiciled status. From April 2017, people who are born in the UK to parents who are domiciled here will no longer be able to claim ‘non-dom’ status and those who own a home in the UK and would normally pay IHT on it will no longer be able to avoid it by holding the property in an offshore structure.

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Most significantly, the Government will abolish permanent non-dom status: from April 2017, people who have been UK residents for more than 15 of the past 20 years will pay full taxes on all their worldwide income and gains. The Chancellor expects these changes to raise £1.5 billion in tax revenue.

Buy-to-let landlords Similarly, the government is ‘levelling the playing field’ between buy-to-let owners and those who buy a new home. ‘Buy-to-let landlords have a huge advantage in the market as they can offset their mortgage interest payments against their income, whereas homebuyers can- not,’ explained Mr Osborne.

Therefore, starting from April 2017, mortgage interest relief on residential property will gradually be restricted to the basic rate of Income Tax.

This buy-to-let measure is likely to have a greater effect on the property sector than the change in non-domiciled status, according to industry analysts. The latter will barely have an impact on the prime London market, according to Mr Bailey, because ‘demand there is driven by a number of factors and a wide range of buyers,’ although Mr Cook warns that, in the short-term, it may heighten price sensitivity.

By contrast, Mr Cook believes that that restricting mortgage relief, together with caps on housing benefits and the possibility of a rise in interest rates in the medium term, may squeeze some investors in lower-value buy-to-let markets and may slow down growth in this area.

However, Miss Gilmore believes that, if today’s low yields remain at similar levels by the time the restriction comes into force, this may result in an upward pressure on rents.

Carla must be the only Italian that finds the English weather more congenial than her native country’s sunshine. An antique herself, she became Country Life’s Arts & Antiques editor in 2023 having previously covered, as a freelance journalist, heritage, conservation, history and property stories, for which she won a couple of awards. Her musical taste has never evolved past Puccini and she spends most of her time immersed in any century before the 20th.

-

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to CairoWhy do we travel and who inspires us to do so? Chris Wallace went in search of answers on his own epic journey the length of Africa.

By Christopher Wallace Published

-

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River Tay

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River TayCarnliath on the edge of Strathtay is a delightful family home set in sensational scenery.

By James Fisher Published