Autumn Cheer for Market

A price rise of 1.3% from Nationwide for October indicates that prices are still picking up towards the end of the year

The price of a typical house in the UK is now £157,107, an increase over the past month of 1.3%, according to mortgage lenders Nationwide. Two of the reasons for this increase seem to be the interest rate cut in August, and consumers? expectations on prices being consistent with an adjusting market: ?The robust price increases in October is likely to reflect a response to the cut in interest rates in August with borrowers who had already decided to buy a house postponing their action in anticipation,? it says. The report goes on to say that the questions for the market now are whether we are at a turning point, and should expect to see house prices beginning to pick up after the steady slowdown during 2005. Amongst other factors which will determine which way the market goes are low affordability, the MPC, who are watching inflation like hawks, and peoples? expectations of house prices, which, the report points out, are often self-fulfilling, and currently show little sign of optimism. It concludes: ?Overall, the data this month suggest a stabilisation in the market rather than a turning point into a period of accelerating house prices.? Analysis from Capital Economics, concurs. Its response to this report says: ?Coupled with recent reports of improving activity levels, today?s report will doubtless spark fresh speculation that the market is in the early stages of a sustained revival, but uncertainty will remain.?

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

-

Game, set, match: Holger Rune and Lorenzo Musetti join the Giorgio Armani Tennis Classic line-up at London's Hurlingham Club

Game, set, match: Holger Rune and Lorenzo Musetti join the Giorgio Armani Tennis Classic line-up at London's Hurlingham ClubThe Danish player, ranked number nine in the world, and the Italian, ranked 11th, will both take to the courts at the 150-year-old Hurlingham Club in London.

By Lotte Brundle Published

-

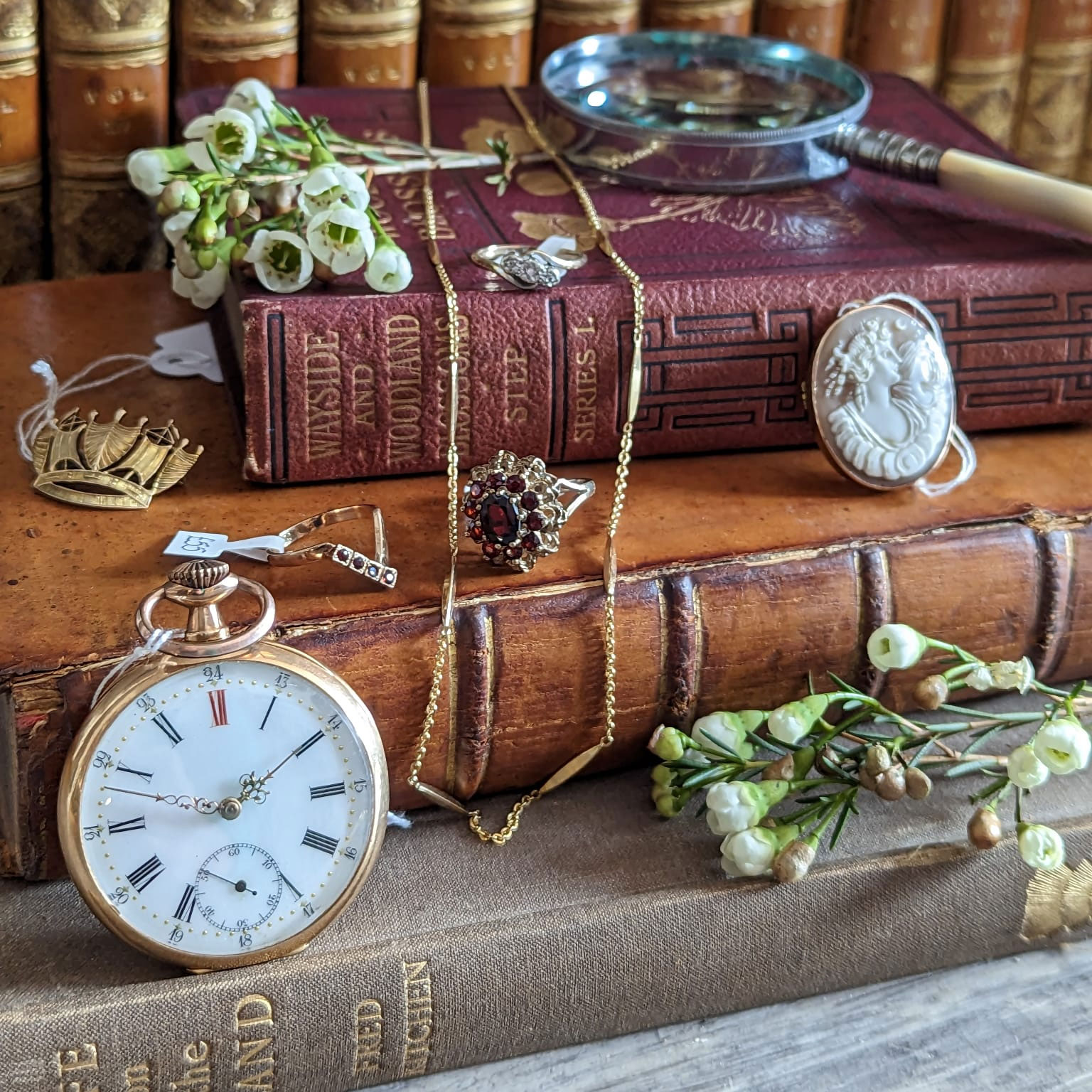

Sell your valuables with ease with The Antique Buying Collective

Sell your valuables with ease with The Antique Buying CollectiveThe Antique Buying Collective treats gold and silver as heirlooms, not scrap. From Victorian brooches to Georgian silverware, each piece is appraised for its history, craftsmanship .and charm, then thoughtfully rehomed through a trusted network. It’s a respectful approach, giving fine antiques the second life they so richly deserve

By Country Life Published