The most successful investments

Carla Passino finds out that against the FTSE 100 index, art, coins, stamps, cars and even furniture, are proving to be excellent investments

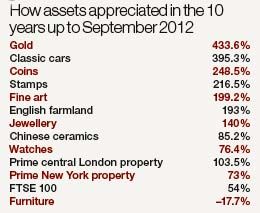

Collectors may sometimes be viewed as eccentric hoarders, but they're having the last laugh. Knight Frank's Luxury Investment Index reveals that passion-driven investments have significantly outperformed more traditional assets, such as the FTSE 100 or even London, New York and Paris property.

With the exception of furniture, all enthusiasm-led purchases have done well. Henry Wyndham, chairman of Sotheby's Europe, explains that ‘2012 was a year of tumbling records, capped by Edvard Munch's The Scream, which we sold for nearly $120 million [£79 million], a world record for any work of art sold at auction'. ‘There has never been so much interest in art and culture,' agrees Jussi Pylkkänen, chairman of Christie's Europe, Middle East, Russia and India. ‘We are seeing demand at every level.' Even with furniture, the best things make ‘huge money', says COUNTRY LIFE's saleroom correspondent Huon Mallalieu. ‘People are realising that, lower down, there are many bargains -partly because old, or "brown", furniture has been talked down so relentlessly. The middle range can be of mixed quality, however, and that is where people really ought to look. As ever, quality is all.'

* Subscribe to Country Life and save; Get the Ipad edition

Stamps have more than trebled in value. One particularly sought-after example, Sweden's tre skilling banco, which was wrongly printed on an amber background rather than the customary blue in 1855, sold in 2010 for £1.7 million. ‘Stamps are quietly building a following among wealthy investors, many of whom are not actually collectors,' reports Andrew Shirley of Knight Frank.

Rare coins have also risen significantly. In January, the Flowing Hair Silver Dollar, minted in 1794, broke all records when it sold at auction for $10 million (about £6.61 million). That said, warns Mr Shirley, the increase quoted is based on the value of the most collectable English coins: ‘Don't hold out much hope for granny's old shillings.'

A Ferrari 250 GTO can be an excellent investment which also brings joy to an owner

The ultimate in collecting indulgence-classic cars- produced what Dietrich Hatlapa, founder of Historic Automobile Group International, calls ‘a turbo-charged performance', even though ‘only the most desirable marques and models will have done this well'. Last June, a 1962 Ferrari 250 GTO made history when it sold for $35 million (£23.2 million), having been bought for $3.5 million (£2.3 million) 16 years earlier. The only asset to have performed better is gold. Although Liam Bailey of Knight Frank advises that ‘values can fall quickly', let's face it, surely an old Aston Martin beats a pile of shiny ingots any time?

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

* Follow Country Life Magazine on Twitter

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

From California to Cornwall: How surfing became a cornerstone of Cornish culture

From California to Cornwall: How surfing became a cornerstone of Cornish cultureA new exhibition at Cornwall's National Maritime Museum celebrates a century of surf culture and reveals how the country became a global leader in surf innovation and conservation.

By Emma Lavelle Published

-

18 magnificent homes for sale from £550k to £20 million, as seen in Country Life

18 magnificent homes for sale from £550k to £20 million, as seen in Country LifeFrom a charming thatched cottage to a 300-acre estate with its own vineyard, here's our pick of places to come to the market via Country Life of late.

By Toby Keel Published