Flood risk homes 'uninsurable'

New homes being built in high flood risk areas may be 'uninsurable and uninhabitable', warn insurers

New homes are being built in high flood risk areas, and may be uninsurable, warns the Association of British Insurers (ABI) today.

Insurers have so far paid out £1billion of claims following the floods of last summer.

Three million new homes are to be built on flood plains by by 2020, and 13 major developments have been passed despite warnings from the Environment Agency. Seven of the sites, including a bungalow development, are deemed at high risk from flooding.

Justin Jacobs, ABI assistant director of property, said: 'The government's ambitious housing plans are in jeopardy unless we reduce the flood risk. Insurers want to continue to provide flood cover, but poor planning decisions will lead to more homes becoming unsaleable, uninsurable and uninhabitable.'

However, John Slaughter of the Home Builders' Federation said that it was not in their interest to build on flood plains: 'We want to build homes to meet the housing crisis, but not just wherever because it's not in the industry's interests to do that. We have to think of our members' reputations long-term.'

The ABI maintains, however, that if new homes are being built in high flood risk areas, they may be uninsurable.

To comment on this article, or on flooding in general, use the comment box below, or email us at clonews@ipcmedia.com. Read more about the countryside.

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

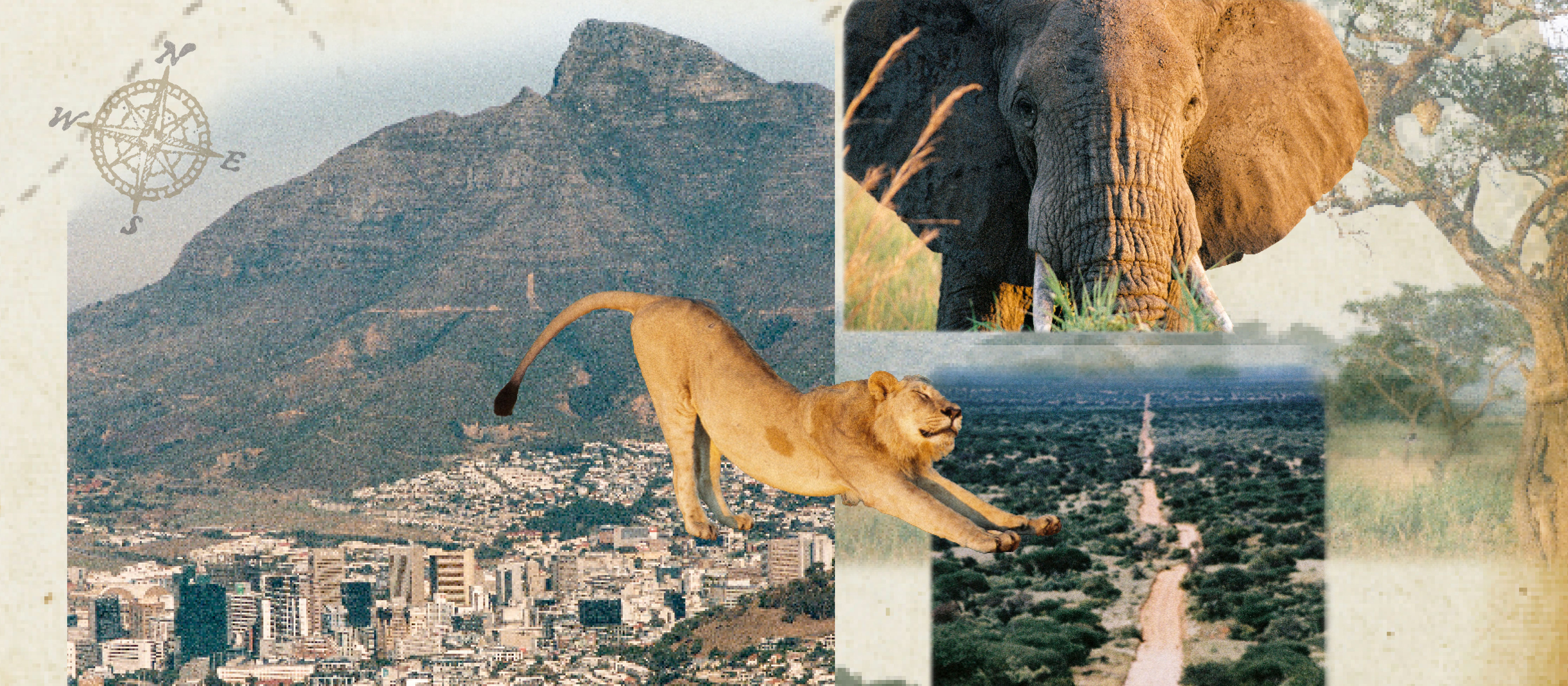

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to CairoWhy do we travel and who inspires us to do so? Chris Wallace went in search of answers on his own epic journey the length of Africa.

By Christopher Wallace

-

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River Tay

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River TayCarnliath on the edge of Strathtay is a delightful family home set in sensational scenery.

By James Fisher