The Farmer's Market

Bovine TB, Russian boycotts and even the perfect harvesting conditions this summer are all affecting farming prices.

Milk prices plummet (Down 6p per litre)

State of play Dairy farmers are smarting at the decline in milk prices this summer. Prices have fallen like a stone from the heady days at the end of 2013, when milk was fetching 34p per litre. Now, a farmer is lucky to receive as much as 28p Farmers for Action says some businesses could see revenues plummet by up to 25%.

This setback comes on top of the soul-destroying stream of positive tests for bovine TB 17,063 cattle had been slaughtered by June this year and the total for 2013 was 32,619. Any farmer experiencing the nightmare of a positive result will see his holding go into ‘lockdown’, adding to feed bills and prompting cashflow and overstocking problems.

Anything else? Johne’s disease, a contagious, wasting condition with no known cure apart from culling, and the common Bovine Viral Diarrhoea (BVD) are further headaches for a troubled industry that is plagued by a significant dropout rate among farmers from 18,000 in 2007/2008 to 14,500 in 2012/2013 an ageing workforce and a shortage of experienced staff.

On the positive side Barns are overflowing with home-produced forage from an Arcadian summer and compound feed prices are down due to the drop in wheat prices.

Beef farmers get a bad deal (Heifer prices down by 19.8%)

State of play Beef farmers experienced a surge in demand for their trusted products after last year’s ‘horsegate’ scandal, but times have been tougher since. Prices that were falling away in October 2013 continued downward until mid summer, although they’ve since begun to rise slightly. But prices have reverted to 2010 levels: the average price for live heifers at auction is 172p/kg (down 19.8%) and 163p/kg for steers (down 30.2%).

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

However, shops and processors have been coining it in. Average retail prices reached 708p/kg during September, up from 685p/kg on the same period in 2013. ‘The news is that the deal is bad for farmers and consumers,’ says Peter Garbutt, the NFU’s chief livestock advisor.

What’s the problem? The inequality of supply and demand has played a major part in the price plummet. Ireland, a huge exporter, has an abundance of beef, as does Europe itself this is, in part, the result of the Middle East outlawing Polish imports after that country banned religious slaughter.

TB continues to blight the industry and the NFU is liaising with Defra to find workable solutions. One is to boost the number of cattle finishing units from the current 125, a woefully inadequate number for Britain’s 80,000 beef farmers.

Apples and pears (UK market share is now 38%)

Climbing the tree New Defra Secretary Liz Truss recently said that she would ‘not rest until the British apple is back at the top of the tree’. The industry is battling against imports, but market share is rising—last year, it was 38%, with 179,400 tonnes of British apples produced, a marked improvement on the paltry 23% market share of 10 years previously. The renaissance is due in part to canny producers listening to the consumer and investing in new varieties, such as the popular Gala. ‘The industry was once depressed and lacking innovation, but now it’s invigorated and prepared to invest,’ comments Adrian Barlow, chief executive of English Apples and Pears.

Blights on the horizon Scab, a black mark on the skin of Gala apples, has affected some 20% of crops this year and the oversupply in Europe due to Russia’s ban on imports will hit prices.

Pears need help There’s less cheering news for the British pear industry, which produces 20,000 tonnes per year out of a total market requirement of 150,000 tonnes and has seen a 2% decline in volume due to a cold snap during the flowering period in March/April. Producers need to revamp old orchards to become competitive, but with an investment requirement of £30,000 per hectare, many are reluctant to put up the cash.

Counting chickens proves profitable (Poultry accounts for 49% of our meat consumption)

Poultry in motion The British Poultry Council (BPC) is in an upbeat mood, because we eat as much poultry 49% as beef, lamb and pork combined and the industry has enjoyed an average year-on-year growth of 1%–1.5%. In 2013, more than 900 million broilers were slaughtered and a record 1.39 million tonnes of meat produced, compared to 1.32 million tonnes in 2012. It’s hoped that, with such a healthy UK market, the recent ban on Russian imports shouldn’t be felt too keenly EU chicken sales to Russia total 6%. ‘The Russian situation isn’t that significant, but it remains an issue, because it prevents market growth,’ points out BPC chief executive Andrew Large.

Eggs-pectations too high? Our egg consumption is a whopping 11 billion, with 5.26 billion eggs sold into the retail sector. Supply can’t keep pace with demand, however, and some 13% of eggs consumed have to be imported. Additionally, by the second quarter of the year, the farmgate price was down by 6.1% to 85.4p per dozen eggs. However, the disparity the UK industry felt in 2012 when it complied with the EU ban on battery cages and many other nations did not, with all the resulting cost implications, seems to have been forgotten. Now, all European countries, bar Italy and Greece, have moved over to the more humane colony cages, leading to a more level playing field.

Pig farmers suffer Russian boycott (Carcass prices down by 9%)

State of play Pork prices are going down to 156p/kg for a carcass last month after a record-breaking 2013 prompted by the horsemeat fiasco. European farmers are getting less for their pig meat, partly because they can’t sell into Russia, their biggest market, and the ripples are being felt on this side of the Channel, too Russia banned EU pork imports in January due to African Swine Fever.

Although Defra cites the risk as ‘low’, should this nightmare disease spread across Europe and into the UK it’s already affecting Latvia, Lithuania and Poland it would be a crisis of foot-and-mouth proportions. ‘The sector is understandably paranoid because affected meat spreads the disease,’ explains Richard Longthorp, chairman of the National Pig Association. ‘It could be brought into the UK and unwittingly fed to pigs. That would wipe out our significant export market overnight.’

Meanwhile, across the Pond Porcine Epidemic Diarrhoea continues to spread across the USA. No one knows how this virulent virus entered America and the industry fears that, one day, it could enter British herds by stealth.

Hong Kong likes our lamb (Eastern exports up by 43%)

The good news British lamb is currying favour in the Far East, notably in Hong Kong. The Far East, which now takes 18% of export volume, increased its UK lamb intake by nearly 50% in the first part of this year, with some 10,000 tonnes of meat exported. Prior to his sacking in July, former Defra Secretary Owen Paterson worked hard on China—British-bred horses may now be sold there and, by 2016, it’s hoped that the UK will have a lamb-export licence to the gargantuan Chinese market. ‘That really would be a game changer for us,’ says Joanne Briggs of the National Sheep Association.

And the bad The hot summer didn’t do the lamb industry any favours demand fell as barbecue cooks opted for beef and pork. August/September also brought unusually late shipments of lower-quality New Zealand lamb; disloyally, a couple of major retailers ran price promotions on these cheap imported meats.

The combination of lower demand and strong supply has forced prices downwards: new-season lambs at auction are showing a 2.3% decline. Demand from France, Britain’s biggest overseas market, taking 55% of total exports, has also fallen by 8%, a combination of a depressed French economy and the strengthening of sterling against the Euro.

Sunshine means stormy times for arable (Bumper wheat mountain = 21% price drop)

Creating a perfect storm With Mother Nature providing sun and rain in just the right proportions globally—except in Kansas, Oklahoma and Texas, where drought has decimated the winter wheat crop—barns are full to bursting. The NFU estimates the UK yield to be a record 8.6 tonnes per hectare, 16% up on 2013. It’s good news for shoppers as food inflation slows, but, ironically, bad news for farmers’ bank balances.

The heady years of 2010–2013, when prices soared, are becoming a distant memory: the £110.50 per tonne for farmgate feed wheat in September is 21% lower than last year and 43% down on 2012. There have also been bumper harvests of silage and hay to feed livestock, but this will impact on wheat growers, because the commercial animal-feed sector is their biggest customer.

What will happen? Farmers with strong business plans should stay afloat, but others will be hit by the triple whammy of the unpopular ‘greening’ (crop rotation) element of the Common Agricultural Policy plus those lower prices and rising maintenance costs. As the going gets tougher, some farmers may regard maize as their new crop of choice or one of the three they need to plant on a rotational basis.

Equally, field beans, those little power packs of protein loved by Middle Eastern markets, could find new British growers the UK is the biggest exporter of field beans behind France, although this trend could be reversed in 2014/2015.

All prices accurate at time of going to press.

This article was originally published in Country Life October 29, 2014

Country Life is unlike any other magazine: the only glossy weekly on the newsstand and the only magazine that has been guest-edited by HRH The King not once, but twice. It is a celebration of modern rural life and all its diverse joys and pleasures — that was first published in Queen Victoria's Diamond Jubilee year. Our eclectic mixture of witty and informative content — from the most up-to-date property news and commentary and a coveted glimpse inside some of the UK's best houses and gardens, to gardening, the arts and interior design, written by experts in their field — still cannot be found in print or online, anywhere else.

-

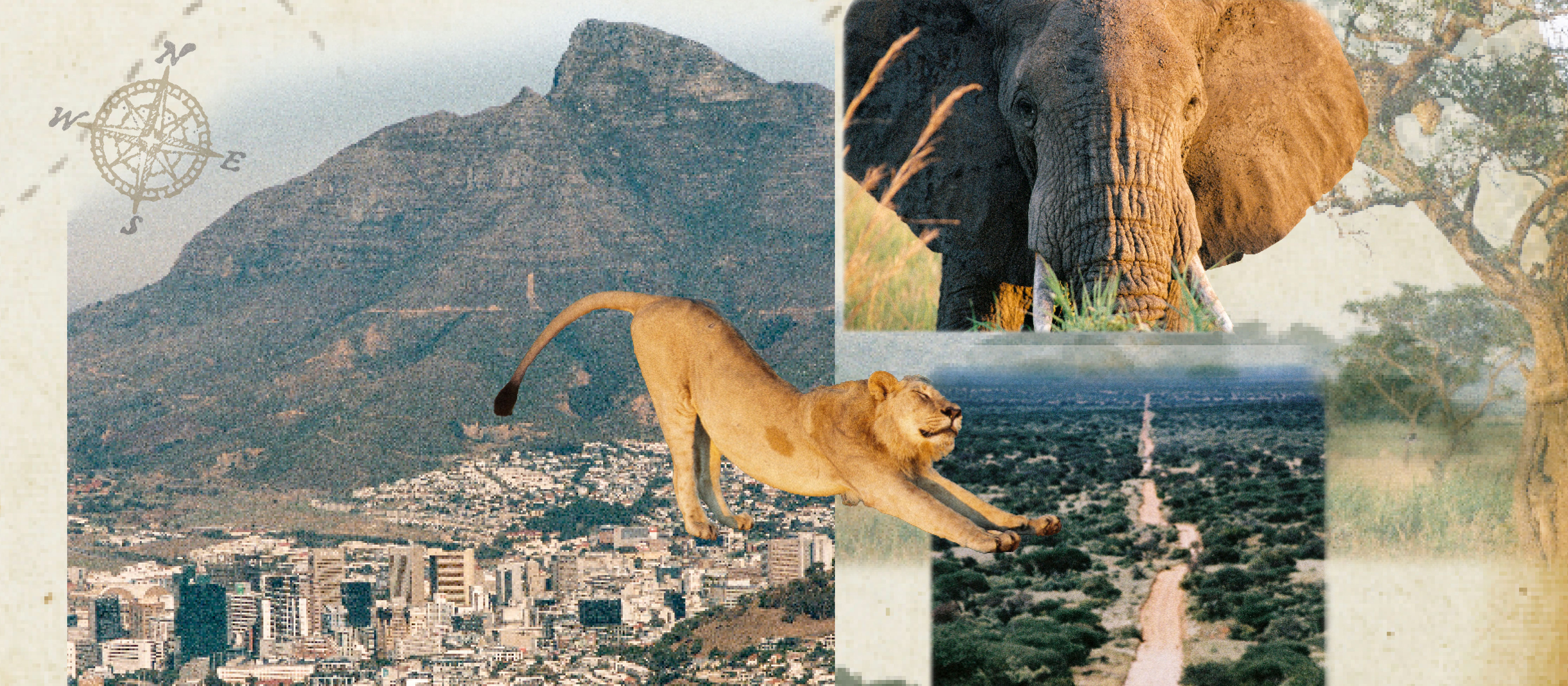

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to CairoWhy do we travel and who inspires us to do so? Chris Wallace went in search of answers on his own epic journey the length of Africa.

By Christopher Wallace

-

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River Tay

A gorgeous Scottish cottage with contemporary interiors on the bonny banks of the River TayCarnliath on the edge of Strathtay is a delightful family home set in sensational scenery.

By James Fisher