Curious Questions: Dirty cash, filthy lucre... but how mucky is our money?

Martin Fone ponders another Curious Question, and comes away thinking that perhaps it's time for us to start money laundering in a very literal sense.

When I first read Thaler and Sunstein’s Nudge: Improving Decisions about Health, Wealth and Happiness (2008), I must confess I was highly sceptical. It's been hailed as the new Holy Grail in behavioural science, but I couldn't escape the notion that an economist and a legal academic had they simply repackaged what we ordinary Joes might term statements of the bleedin’ obvious in the patina of faux academic respectability.

The basic premise, for the uninitiated, is that positive reinforcement and indirect suggestion is by far the most effective way of changing minds and behaviour. Rather than bombarding the general public with warnings backed up by legislation and enforcement, a more subtle approach is best.

Thaler and Sunstein's lessons have certainly been taken seriously. Looking around me these days I find numerous examples of organisations and authorities effecting helpful changes to the way they operate in order to make life easier for us, or so they say, and we cheerfully go along with it. One of the most profound, less a nudge than a full-blooded shoulder charge, is the move to a cashless society.

First, the introduction of chip and PIN technology, then contactless payments, followed in short order by the closure of many branches of our high street banks and the reduction in the number of cash machines. Before you know it, you have retail outlets that refuse to take cash because of the sheer effort of finding a bank that will give them change and we think nothing of handing over our debit or credit cards to make a purchase. Even professional buskers in our metropolis accept card payments. According to a report by UK Finance, the banks’ trade body, in a decade fewer than 10% of financial transactions will involve cash.

I am of an age to still derive some comfort in having a bit of small change rattling in my pocket but I am finding that increasingly I am bowing to the inevitable, buying more and more with that 3 3⁄8 × 2 1⁄8 inches (in old money) bit of plastic in my wallet. I do have some rules — I prefer to pay cash when buying alcohol to consume on the premises — but even then, I find it easier to wave my flexible friend.

Pondering over this fundamental financial revolution, the thought struck me: are the banks doing their bit to improve public health? The problem with cash, whether coins or notes, is that you haven’t a clue where it has been and other people may not be as fastidious as you over matters of personal hygiene. Holding my nose, I decided to investigate the germ-carrying properties of money further.

It is probably not surprising to find that there have been a number of research studies into the subject and their findings can be momentarily headline grabbing, such as the report on how there are more germs on a £1 coin than a toilet seat. Seeking a bit more academic rigour, I turned to some research conducted by scientists at London Metropolitan University.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Taking a random selection of coins and notes, they found nineteen different types of bacteria, including Staphylococcus aureus, the bug associated with MRSA, and Enterococcus faecium, a bacterium that can cause blood, abdomen, skin, and urinary tract infections. What was particularly shocking, according to the University’s Dr Paul Matewele, was how many micro-organisms were thriving on metal, an element that you wouldn’t normally expect germs to adapt to.

Across the pond, US notes, an attractive mix of 75% cotton and 25% linen, provide myriad crevices for bacteria to make their home there. A study conducted in the labs of the U.S Air Force in 2002 on 68 one-dollar bills found that 94% of them were harbouring bacteria, some that could cause pneumonia and other serious infection. Swiss researchers in 2008 found that a flu virus that could survive for a couple of days on Swiss francs could linger on for up to 17 days if accompanied by mucus.

'The Romanian Leu was the dirtiest of the lot.... The only currency tested where none of the cultures survived was the Croatian Luna. You may want to factor that into the equation when you consider your next holiday jaunt'

My attention was then drawn to a study published in the ever popular journal, Antibactorial Resistance and Infection Control, in 2013 called Money and transmission of bacteria by Messrs Habip Gedik, Timothy and Andreas Voss, for which they were awarded the Ig Nobel prize for Economics in 2019. The intrepid trio sought to establish the survival rates of bacteria such as those that are associated with MRSA and e-coli and a form of Enterococcus (VRE) which affects the intestines and genital tracts on a selection of banknotes.

The notes were inoculated with strains of each of the cultures, incubated for 24 hours, and then dried for three, six and twenty-four hours. They found that the Romanian Leu was the dirtiest of the lot, head and shoulders worse than the likes of the Indian rupee, the US dollar and the Moroccan Dirham, retaining all three sets of bacteria after six hours and with VRE lingering after a day in the drier. E-coli lingered on the Euro up until the six-hour point. The only currency tested where none of the cultures survived at any stage was the Croatian Luna. You may want to factor that into the equation when you consider your next holiday jaunt.

Surely, there is a strong case for money laundering in the literal sense rather than the figurative.

The curious point in all this research is that whilst money, whether notes or coinage, is demonstrably laden with bacteria, there seems to be no definitive research that shows a link between filthy lucre and people becoming sick through handling it. Given that we have been using notes and coins for centuries, if there was a direct causal link between handling them and sickness you would have thought that the penny would have dropped before now.

On the other hand, it could happen. After all, some diseases, such as influenza, norovirus, and the like, are manifestly transmitted by hand-to-hand contact or by touching a surface, so why should money be immune?

Help may be at hand from the polymer notes introduced with into England and Wales by the Bank of England on September 13, 2016 with the new-style five pound note. A study led by Professor Frank Vriesekoop of Harper Adams University found that these new notes are three times cleaner than their cotton-based predecessors and that bacteria found on human hands are less likely to stick on them.

Perhaps the banks are really doing their bit to improve public health and, inadvertently, spawning a proverb for the 21st century; waving your plastic friend each day keeps the doctor away.

Martin Fone is the author of 50 Curious Questions and 50 Scams and Hoaxes, among other books

Curious Questions: Why do Australians call the British 'Poms'?

With England about to take on Australia in The Ashes, Martin Fone ponders the derivation of the Aussies nickname for

Credit: Alamy

Curious questions: Are you really never more than six feet away from a rat?

It's an oft-repeated truisim about rats, but is there any truth in it? Martin Fone, author of 'Fifty Curious Questions',

Curious Questions: What's the world's largest totem pole?

Martin Fone finds himself intrigued by the totem pole, and wonders which is the biggest ever made.

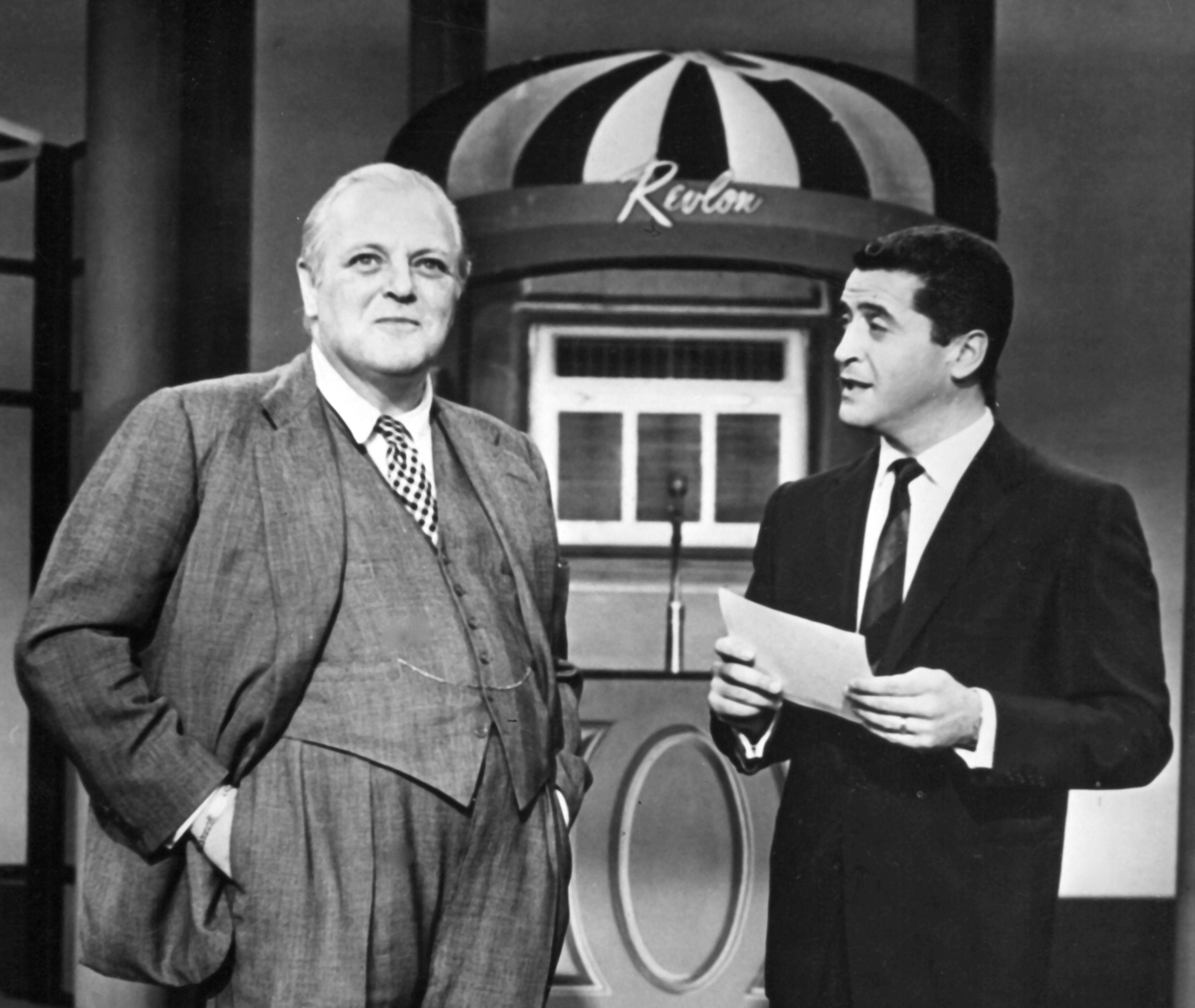

Curious Questions: Why do we talk about the '$64,000 question' — even in a country where we don't use dollars?

A question about a question? Absolutely. Martin Fone gets to the bottom of where this curious phrase originates — and how

Credit: apples and oranges Photo by Best Shot Factory/REX/Shutterstock

Curious Questions: Can you actually compare apples and oranges?

It's repeated so often these days that we've come to regard it as a truism, but are apples and oranges

After graduating in Classics from Trinity College Cambridge and a 38 year career in the financial services sector in the City of London, Martin Fone started blogging and writing on a freelance basis as he slipped into retirement. He has developed a fearless passion for investigating the quirks and oddities of life and discovering the answers to questions most of us never even think to ask. A voracious reader, a keen but distinctly amateur gardener, and a gin enthusiast, Martin lives with his wife in Surrey. He has written five books, the latest of which is More Curious Questions.