-

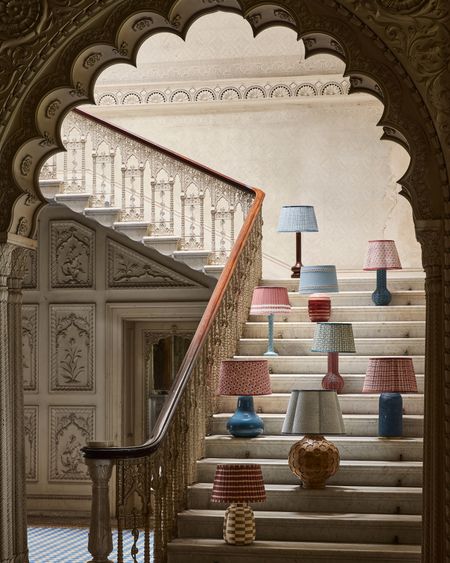

What are these? Take a punt in the Country Life Quiz of the Day, March 10, 2026

By Country Life -

-

'I have 12 dogs and they are my greatest joy': These are a few of Manolo Blahnik's favourite things

By Amie Elizabeth White -

Do androids dream of electric cars, with Adam Hay-Nicholls

By James Fisher -

What you'll find in this week's issue of Country Life — and how to subscribe or get your copy

By Country Life -

This Georgian church is now a gorgeous country home — and it was designed by a student of Sir John Soane

By Julie Harding -

‘Never back a grey horse’: Where the Cheltenham Festival superstition comes from

By Jack Watkins -

The sad clown dog that won Best in Show at Crufts

By Matthew Dennison

-

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

People & Places

-

-

The life of a BAFTA begins in an industrial estate in Braintree

-

The W1 set is up in arms about Liz Truss's roof terrace. But what is a members' club without one?

-

What have the Romans ever done for us? For one thing, taught us the art of seduction

-

‘I’m like: “Give me those tights, let me show you”: Ballet superstar Carlos Acosta’s consuming passions

-

Property

View all Property-

This Georgian church is now a gorgeous country home — and it was designed by a student of Sir John Soane

By Julie Harding -

-

One of the last working windmills in Britain is for sale at £350,000

By Toby Keel -

The Suffolk house where two of the greatest women in British history spent their childhood years

By Toby Keel -

22 charming country properties, from £350,000 to £2.5 million, as seen in Country Life

By Toby Keel -

This is quite possibly the greatest clifftop house in the world, and it's on the market right now

By Toby Keel -

A murdered entrepreneur, an iconic London department store, a £1.5 billion makeover, and the quest to create 'the capital’s greatest residential address'

By Julie Harding -

'It took my breath away when I first walked in': A Hertfordshire home with a kitchen to die for

By Julie Harding

-

Architecture

View all Architecture-

From baroque masterpiece to the UKs most picturesque motor circuit: The tragic tale of Oulton Park and its inhabitants

By Melanie Bryan -

-

At war in a foreign country, jailed by your own son and traded as a teenager as part of a business proposition: The ladies of Leeds Castle saw it all

By Laura Kay -

'A celebration of connoisseurship and the sheer enjoyment of art and history': The extraordinary treasures of Ampthill Park House

By Jeremy Musson -

There's a town in the Netherlands where you can build whatever you want. The outcome is quite extraordinary

By Tim Abrahams -

Gibside: The curious roofless castle where The King's ancestor was kidnapped

By Melanie Bryan -

'A blue-blood background and a drive to disrupt': Lady Violet Manners on the importance of preserving Britain's privately-owned country homes

By Owen Holmes -

A Suffolk home where glass, steel, timber and thatch come together in perfect harmony

By Clive Aslet -

Why has everyone fallen under the spell of Wrotham Park — one of the largest private houses inside the M25

By Laura Kay

-

Our expert voices

Interiors

View All Interiors-

How do you make an 18th century stately home fit for a 21st-century family?

By Grace McCloud -

-

Reader Event: An eye to the future at Daylesford Heritage House

Sponsor Content Created With Daylesford

By Giles Kime -

New designs and accessories to brighten every room

By Amelia Thorpe -

London Design Week: What to look out for at next month's unmissable interiors event

By Amelia Thorpe -

How do you add historic character back into a soulless room?

By Arabella Youens -

This clever interiors trick is the secret to creating multifunctional spaces — and it was integral to the design of many English country houses of the past

By Giles Kime -

'It was a complete wreck': Reclaiming a Hampshire coaching house from the earth

By Arabella Youens -

How do you add a dash of theatricality to a 1930s house? By taking inspiration from the legendary architect and set designer Oliver Messel

By Arabella Youens

-

Gardens

View All Gardens-

Colour photographs of Gertrude Jekyll’s garden, rediscovered in the Country Life Archive, offer a rare glimpse of what it looked like at the peak of her fame

By Country Life -

-

A dream built in glass, for herbs, flowers and 'lots of fancy tomatoes'

By Tiffany Daneff -

No garden should be without a winter-flowering daphne, so we've picked the best

By Charles Quest-Ritson -

'It was the only design that spoke the same language as the house. It immediately felt right': An Oxfordshire home where house and garden work in perfect, asymmetrical harmony

By Tiffany Daneff -

You don’t need to live in the countryside or have acres of space to start a cutting garden

By Amy Merrick -

Intrepid, enterprising, dedicated: The new generation of nursery owners creating the flowers we'll be enjoying for decades to come

By John Hoyland

-

LIFE & STYLE

View All LIFE & STYLE-

-

Do androids dream of electric cars, with Adam Hay-Nicholls

By James Fisher -

The sad clown dog that won Best in Show at Crufts

By Matthew Dennison -

Why is this so red? The answer is waiting in the Country Life Quiz of the Day, March 9, 2026

By Country Life -

From palaces to football pitches, the women devoted to their dogs

By Florence Allen

-

THE COUNTRYSIDE

View All THE COUNTRYSIDE-

-

What is it, therefore, that makes a good walking stick?

By Gabriel Stone -

Flying high: The birds doing brilliantly in the British Isles right now

By Mark Cocker -

Power struggles: The countryside should not be viewed as an empty canvas on which to achieve everyone’s aims

By Country Life

-

ART & CULTURE

View all ART & CULTURE-

-

Easel on the eye: The genius of John Piper

By Carla Passino -

Pamela Goodman: In the battle of the beauties, Mona Lisa will always come out on top

By Pamela Goodman -

A right royal affair with the stars

By Matthew Dennison -

Thomas Gainsborough means one thing in Britain. He means another in America

By Owen Holmes

-

Travel

View All Travel-

Nay Palad Hideaway review: The surfing Mecca that feels like Bali before the beach clubs

By Lauren Ho -

-

Where to honeymoon according to Alan Titchmarsh, Cath Kidston and more

By Amie Elizabeth White -

There are more than 100 species of lemur living on the world's fourth-largest island — and they cannot be found anywhere else on Earth

By Rupert Uloth -

In the battle of travel tour operator versus AI, who will win?

By Rosie Paterson -

Hôtel du Couvent: This former convent on the French Riviera has rekindled the rules of luxury

By James Fisher -

This Hollywood star's home in the Canadian wilderness is now an exclusive-use lodge

By Rosie Paterson

-

Food & Drink

View All Food & Drink-

The definitive guide to London's best afternoon teas

By Country Life -

-

Thomas Straker: ‘I don’t think anyone has ever left a restaurant going, “God I wish I’d eaten more purée”’

By Jo Rodgers -

A very brief history of brown sauce

By Harry Pearson -

Forget museums, the pub is where real history happens

By Ashleigh Arnott -

It's alive! The UK producers embracing fermentation to make delicious products teeming with life

By Tom Howells -

‘French pastries all look amazing… but I wish more British bakers would look at what we used to have’: Richard Hart on the joys of jammy dodgers and iced buns

By Oliver Berry -

Where's the rum gone? How the temperance movement took on the Royal Navy

By Henry Jeffreys

-