-

A country house that's 'the finest-looking estate between the Humber and the Tweed' (at least according to Queen Victoria)

By Toby Keel

-

-

Liverpool and literature: Country Life Quiz of the Day, July 18, 2025

By Country Life

-

William Kendall: 'We need to build a lot more solar farms and some wind turbines, too'

By William Kendall

-

‘Everyone had dodgy magazines hidden under their beds and I had interior design magazines’: James Thurstan Waterworth's consuming passions

By Lotte Brundle

-

Six beautiful homes around the world, from Portofino to Provence to Palm Beach

By Toby Keel

-

Eat our local cheeses or lose our local cheeses, warns Neal's Yard Dairy

By Emma Hughes

-

The 'greatest battle for 300 years': England's great estates face up to a green future

By Jane Wheatley

-

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

People & Places

-

-

‘‘In the silence, it is the most perfect blue I have ever seen. If my goggles weren’t already overflowing with water I might even weep’: Learning to freedive on the sparkling French Riviera with a five-time World Champion

-

West London's spent the last two decades as the laughing stock of the style set — here's how it got its groove back

-

‘To this day, it is as attractive as when Hercules first laid eyes on it’: How to escape the crowds on the Amalfi Coast, according to those in the know

-

Brat behaviour: The chef behind Shoreditch institution Brat and Soho favourite Mountain is running away to Wales

-

Property

View all Property-

A country house that's 'the finest-looking estate between the Humber and the Tweed' (at least according to Queen Victoria)

By Toby Keel

-

-

Six beautiful homes around the world, from Portofino to Provence to Palm Beach

By Toby Keel

-

An idyllic home where the forest meets the sea, for sale for the first time in over half a century

By Penny Churchill

-

'Just look at those stairs. Just as an art form, they are bewitching, like the shell of a nautilus': The lure of buying a stairway to heaven

By Toby Keel

-

Best country houses for sale this week

By Country Life

-

The one-of-a-kind estate with two private beaches and a surf house on storied Martha's Vineyard island

By Rosie Paterson

-

The architect who created the MI6 building only designed a tiny handful of houses — and one of them is now up for sale in one of London's most bucolic spots

By Toby Keel

-

Our expert voices

Interiors

View All Interiors-

21 of the greatest craftspeople working in Britain today, as chosen by the nation's best designers and architects

By Giles Kime

-

-

The transformative renovation of a Grade II-listed property with an 'unusual footprint'

By Arabella Youens

-

I've seen the light: How a dark and gloomy kitchen in the Scottish Borders was reconfigured for 21st century living

By Arabella Youens

-

'Comfortable, cosseting and far from the madding crowd': The recently refurbished Cornish cottage that proves Victorian decor is making a comeback

By Giles Kime

-

18 inspiring ideas to help you make the most of meals in the garden this summer

By Amelia Thorpe

-

'These aren't just rooms. They are spaces configured with enormous cunning, artfully combining beauty with functionality': Giles Kime on the wonders of WOW!house 2025

By Giles Kime

-

How the deep-lustre of copper brings period glamour to this kitchen

By Arabella Youens

-

The beauty’s in the detail: How English stone specialist Artorius Faber helped to bring Country Life's Chelsea stand to life

By Artorius Faber

SPONSORED

-

LIFE & STYLE

View All LIFE & STYLE-

-

Sophia Money-Coutts: Is there even any point in setting an out of office, these days?

By Sophia Money-Coutts

-

The teeny tiny car that you absolutely don’t need, but will absolutely want this summer — and it has an inbuilt shower

By Rosie Paterson

-

‘It only remains for our descendants to curse our impotence and laissez-faire’: Only four photographs of a storied London townhouse survive inside the Country Life archive — and it was brutally demolished not once, but twice

By Melanie Bryan

-

You can’t always rely on the Great British summer — but you can rely on its watches

By Chris Hall

-

COUNTRYSIDE

View All THE COUNTRYSIDE-

-

The 'greatest battle for 300 years': England's great estates face up to a green future

By Jane Wheatley

-

'He unleashed a series of war cries, then intercepted the vole mid-air': There's nothing remotely common about the common kestrel

By Mark Cocker

-

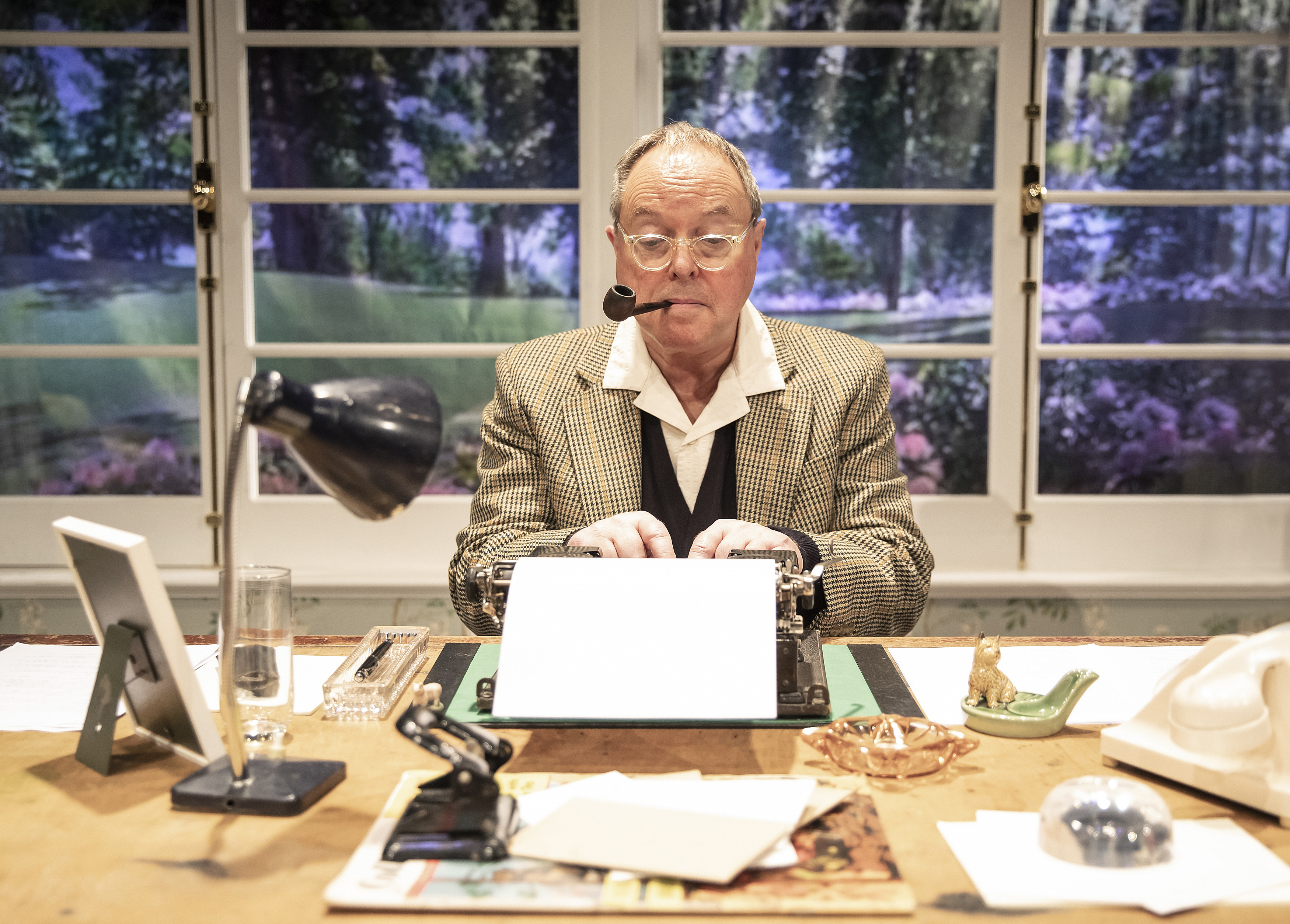

The truth about P.G. Wodehouse: Robert Daws on playing England's greatest comic writer

By Toby Keel

-

Gardens

View All Gardens-

Five British gardens have a starring role on the New York Times's list of 25 must-see gardens — here are the ones they forgot

By Lotte Brundle

-

-

The garden created by a forgotten genius of the 1920s, rescued from 'a sorry state of neglect to a level of quality it has not known for over 50 years'

By George Plumptre

-

Alan Titchmarsh: My garden is as pretty as I've ever known it, thanks to an idea I've rediscovered after 50 years

By Alan Titchmarsh

-

The Hollywood garden designers who turned their hand to a magical corner of Somerset

By Caroline Donald

-

Sarah Raven: The flowers I have that are flourishing superbly, despite the battering heat

By Sarah Raven

-

The 'Rose Labyrinth' of Coughton Court, where 200 varieties come together in this world-renowned garden in Warwickshire

By Val Bourne

-

ART & CULTURE

View all ART & CULTURE-

-

101 gold rats, a 'self portrait as a horse' and a tribute to motherhood take home top prizes at this year's Royal Academy Summer Exhibition

By Lotte Brundle

-

‘One of the most effective pieces of propaganda ever made’: the Bayeux Tapestry heads to Britain for the first time in almost a millennium

By Carla Passino

-

‘They remain, really, the property of all of those who love them, know them, and tell them. They are our stories, the inheritance of the people of Scotland’: The Anthology of Scottish Folk Tales

By Patrick Galbraith

-

Canine muses: Lucian Freud's etchings of Pluto the whippet are among his most popular and expensive work

By Agnes Stamp

-

Travel

View All Travel-

'I found myself in a magical world of a sun-dappled forest, speckled with wild flowers of kaleidoscopic colours and brilliant mosses': Solo walking in the Pyrenees

By Teresa Levonian Cole

-

-

Beyond Royal Portrush: Castles, country houses and ancient towers in the other dimension of golf in Ireland

By Toby Keel

-

‘To this day, it is as attractive as when Hercules first laid eyes on it’: How to escape the crowds on the Amalfi Coast, according to those in the know

By Luke Abrahams

-

The 'strikingly beautiful, authentic and innovative' Highland castle that's been saved for the ages, and available to rent by the weekend

By Mary Miers

-

Jnane Rumi, Marrakech, hotel review: 'The most talked about opening this year — and for good reason'

By Christopher Wallace

-

‘‘In the silence, it is the most perfect blue I have ever seen. If my goggles weren’t already overflowing with water I might even weep’: Learning to freedive on the sparkling French Riviera with a five-time World Champion

By Chris Cotonou

-

Food & Drink

View All Food & Drink-

Eat our local cheeses or lose our local cheeses, warns Neal's Yard Dairy

By Emma Hughes

-

-

'Some would argue an unbaked cheesecake isn’t a cheesecake at all. They're wrong': Gill Meller's blackcurrant and lemon cheesecake recipe

By Gill Meller

-

Tom Parker Bowles: This 90-year-old Italian restaurateur makes the world's best sorbet and granita

By Tom Parker Bowles

-

Brat behaviour: The chef behind Shoreditch institution Brat and Soho favourite Mountain is running away to Wales

By Will Hosie

-

The last miracle of St Boswell? How a Scottish potato field became the world's least-likely producer of sparkling wine

By Lotte Brundle

-

How to make The Connaught Bar's legendary martini — and a few others

By Rosie Paterson

-

Gill Meller's tomato, egg, bread and herb big-hearted summer salad

By Gill Meller

-